How to Withdraw Cash from ATM using UPI | UPI-ATM

Want to know how to withdraw cash from ATM using UPI? Have you ever encountered a circumstance when you needed cash immediately but didn’t have access to an ATM card? Cash withdrawals through ATMs can be useful, especially in areas where UPI and internet payments are less widespread. Debit cards can be used to make contactless purchases without a PIN, thus having one on you always carries some inherent hazards. Additionally, it can be used to defraud users of unauthorised ATMs. Account customers can now withdraw money even without using debit cards for their safety. UPI-ATM ICCW can be used to do this.

Account users now have the option to withdraw cash from their accounts without using a debit or credit card thanks to ICCW, or Interoperable Card-less Cash Withdrawal. Since the cardholder only needs to utilise their mobile banking app to request a card-less cash withdrawal, this service is simple to use. Due to the increase in digital transactions, ICCW makes sure that consumers can simply conduct card-less cash withdrawals. Customers have the option to withdraw cash whenever it suits them thanks to the service.

Instead than using the ATM, users would now have to use their UPI apps. When using ATMs to withdraw cash, this service will increase security by adding additional layers. Customers must have a UPI-compatible mobile banking app or another UPI app in order to use this service.

Contents

Features of the UPI-ATM (ICCW) Service

- The service enables simple transactions without using a card.

- For cash withdrawals from ATMs, people do not need to carry their debit or credit cards with them.

- Users will be able to utilise the UPI app to withdraw money from different accounts.

- The service has a 10,000 rupee transaction cap. But it could differ from one bank to another. The maximum is covered by the daily Rs. 1 lakh total transfer limit using UPI.

- It uses two-step verification to increase security and lessen the possibility of fraudulent transactions.

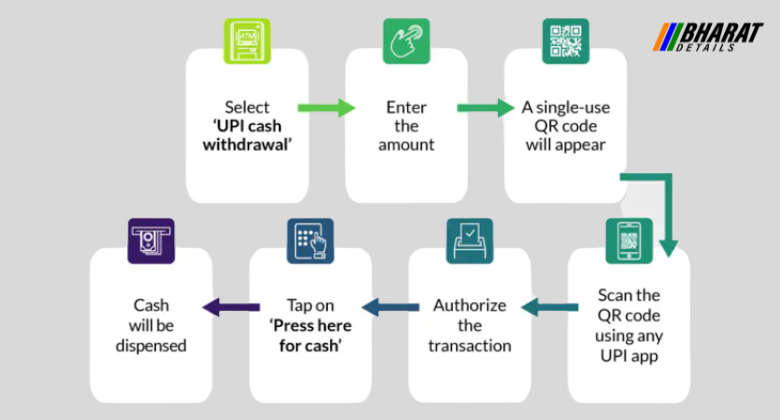

How to Withdraw Cash at ATM using UPI-ATM ICCW

Step 1: At the ATM, select ‘UPI cash withdrawal’ option

Step 2: ATM will ask you to enter the amount that you want to withdraw

Step 3: You will be prompted with a single-use QR code on the screen

Step 4: Scan the prompted QR code on the screen using any UPI application on your mobile

Step 5: Authorize the transaction. UPI will be debited upon authorization

Step 6: On the ATM, tap on ‘Press here for cash’

Step 7: Your cash will be dispensed

Banks Offering UPI-ATM (ICCW) Services

Below-mentioned is the list of banks that are currently active on ICCW service:

| Bank of Baroda | City Union Bank |

| Canara Bank | Central Bank of India |

| IndusInd Bank | Yes Bank |

| Ujjivan Small Finance Bank | The Mehsana Urban Co-operative Bank |

Please be aware that at this time only Bank of Baroda and City Union Bank ATMs accept cardless transactions. Customers of the other banks on the above list, however, can withdraw cash without a card using the ATMs of Bank of Baroda and City Union Bank. The ICCW facility also has the BHIM UPI app operational.

Key Points of ICCW

- No need to bring numerous cards with you when using an ATM

- The facility will stop card-related scams like skimming, cloning, and others.

- Customers can use this service even if they are not given actual cards.

- A digital (Paperless) transaction

Fees and Charges

Customers are permitted to use their own bank ATMs for 5 transactions per month, both financial and non-financial. Additionally, they are qualified to use free transactions from other bank ATMs (including financial and non-financial transactions), limited to three in metro areas and five outside of them. Customers will then be charged Rs. 20 for each subsequent transaction.

Maximum Withdrawal through UPI-ATM

According to the initial plans, only Rs. 1 lakh per month can be withdrawn because UPI can only handle transactions up to Rs. 1 lakh per month. Additionally, there is a daily upper limit of Rs. 10,000. However, the aggregate withdrawal limit will drop if additional UPI transactions are made using the same account.

The banks may need some time to fully implement this new facility, despite the fact that it is safer and more practical. More banks are anticipated to join the platform and provide their consumers this facility and flexibility even though this facility is still in its early stages. However, the maximum withdrawal cap is anticipated to remain the same until

According to the initial plans, only Rs. 1 lakh per month can be withdrawn because UPI can only handle transactions up to Rs. 1 lakh per month. Additionally, there is a daily upper limit of Rs. 10,000. However, the aggregate withdrawal limit will drop if additional UPI transactions are made using the same account.

The banks may need some time to fully implement this new facility, despite the fact that it is safer and more practical. More banks are anticipated to join the platform and provide their consumers this facility and flexibility even though this facility is still in its early stages. However, the maximum withdrawal cap is anticipated to remain the same until the facility gets popular among masses.