Fortis Healthcare to Acquire 31% Stake in Agilus Diagnostics for Rs 1,780 Crore

Fortis Healthcare is planning to buy a 31% stake in Agilus Diagnostics from private equity investors for Rs 1,780 crore, valuing the company at Rs 5,700 crore. These private equity firms are using a put option to sell their shares.

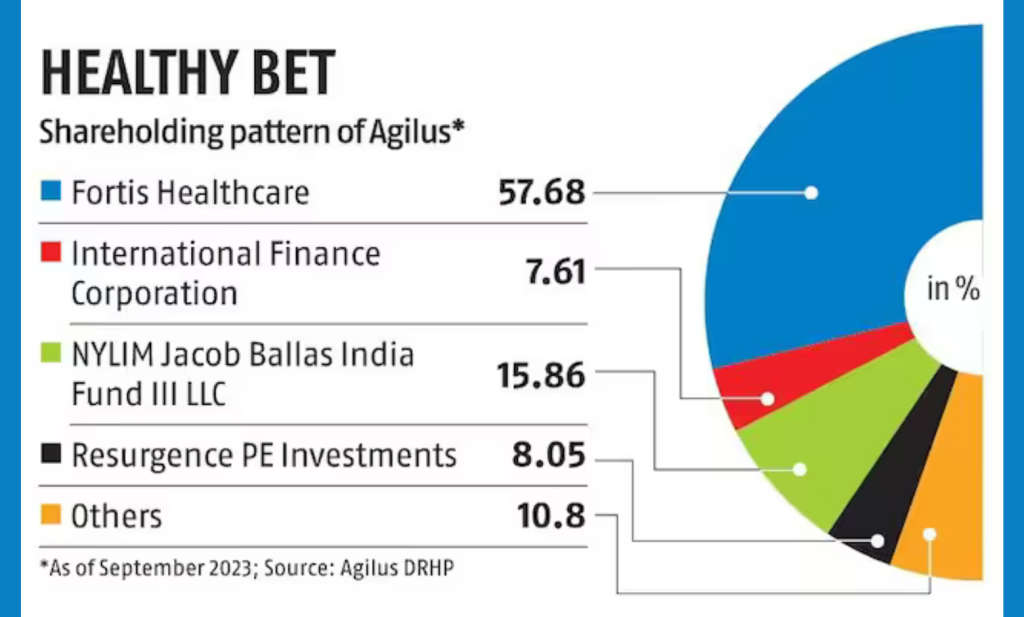

Fortis has already received a letter from NYLIM Jacob Ballas India Fund III LLC (NJBIF) to sell its 15.86% stake for Rs 905 crore. Letters from the other private equity investors, International Finance Corporation (IFC) and Resurgence PE Investments Limited (formerly Avigo PE Investments Limited), are expected to be received by August 13.

The deal values Agilus Diagnostics at Rs 5,700 crore, which is 20 times the expected enterprise value to EBITDA ratio for FY26. According to analysts at Nuvama, Fortis Healthcare plans to fund this acquisition with a Rs 1,500 crore debt at an interest rate of 10-10.5%, which may affect the company’s profit margins.

In the first quarter of FY25, Agilus reported net revenues of Rs 309.6 crore, with an EBITDA of Rs 55.5 crore and a margin of 18%. In comparison, Dr. Lal Pathlabs, India’s largest diagnostic company, has a market cap of Rs 26,669.89 crore as of August 8, 2024, and reported revenues of Rs 534 crore for the same period. Metropolis Healthcare, another leading diagnostic company, has a market cap of Rs 10,575.16 crore and posted revenues of Rs 292.27 crore in Q4FY24 and Rs 1,103.43 crore for the entire FY24.

Want to Book a test visit ➡️ Agilus Diagnostics

Fortis announced in a stock exchange notice that the three private equity investors have exit rights for their shares in Agilus, including the option to sell them at market value by August 13, 2024, as per the shareholders’ agreement from June 12, 2012.

Fortis Healthcare confirmed receiving a letter on August 7 from NJBIF regarding the exercise of a put option to sell 12.43 million shares, representing a 15.86% equity stake in Agilus, for Rs 905 crore. Fortis stated they are evaluating the situation and taking necessary steps to meet their contractual obligations under the agreement, while also adhering to applicable laws.

Also read ➡️ How To Register For Ladki Behini Yojana? Complete Process And Benefits Explained

Previously, IHH Healthcare from Malaysia, which owns a majority stake in Fortis Healthcare, attempted to assist in selling the private equity stake by hiring bankers to find a buyer. In September 2023, Fortis had filed a Draft Red Herring Prospectus (DRHP) for an IPO with SEBI, but this was later canceled in February. The DRHP outlined plans for a sale of 14.2 million shares by Agilus investors, including IFC, NJBIF, and Resurgence PE Investments.

Nuvama analysts noted that Fortis’s commitment to expanding its hospital network is reassuring and Agilus’s potential recovery could unlock value in the future. However, rebranding and regulatory challenges have hindered Agilus’s growth. Analysts expect Agilus to reach industry-level growth by FY26, with estimated revenue and EBITDA growth rates of 8% and 17% CAGR from FY24 to FY27, respectively.

Agilus Diagnostics, formerly known as SRL, is still adjusting to recent rebranding efforts, which cost Rs 9 crore in the first quarter of FY25. The company plans to spend approximately Rs 50 crore on rebranding in FY25. As of June 30, 2024, Agilus has 4,055 customer touchpoints.