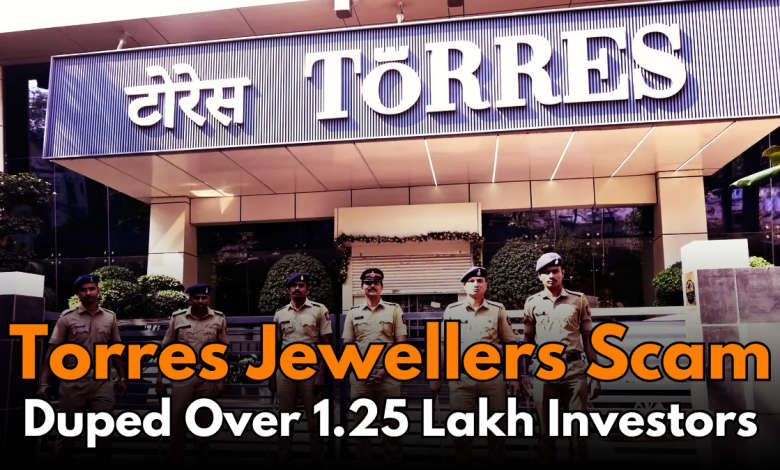

The Torres Jewellers Scam: How a Multi-Crore Fraud Duped Over 1.25 Lakh Investors

In a shocking financial fraud case, Mumbai-based jewellery chain operator Torres Jewellers has allegedly defrauded nearly 1.25 lakh investors through a Ponzi scheme, promising exceptionally high returns. The scandal, which unfolded towards the end of 2024, has left countless investors in financial distress.

Contents

The Rise and Fall of Torres Jewellers

Torres Jewellers began offering investment schemes in February 2024, claiming substantial returns on purchases of moissanite stones and other jewellery products. According to reports, the company promised investors a weekly payout of 6% on their investments. Additionally, customers investing INR 1 lakh were offered a pendant with a moissanite stone valued at INR 10,000. However, it later came to light that these stones were fake and merely used as tokens to lure more investors.

The company presented itself as a lucrative investment opportunity, offering annual returns of 48% on gold purchases, 96% on silver investments, and a staggering 520% on moissanite purchases. Such returns attracted thousands of investors, many from lower-middle-class backgrounds, who trusted the scheme with their life savings.

How the Scam Fell Apart

As Christmas and New Year approached in late 2024, Torres Jewellers increased their payout rates from 6% to 13%, enticing even more people to invest. But by December 30, 2024, all payments stopped abruptly, and communication with the company ceased.

Investors began to panic when Torres showrooms shut down without any prior notice. Crowds of desperate investors gathered outside the Shivaji Park Police Station, seeking answers and assistance in recovering their money. Reports suggest that many individuals had convinced their friends and family to invest, amplifying the collective losses.

Who Are the Accused?

The authorities have arrested three individuals in connection with the scam: Sarvesh Ashok Surve, Tania alias Tazagul Karaxanovna Xasatova, and Valentina Ganesh Kumar. However, the alleged masterminds, Ukrainian nationals John Carter and Victoria Kowalenko, are believed to have fled India.

The Economic Offenses Wing (EOW) has launched an investigation under the Maharashtra Protection of Depositors Act and multiple sections of the Bharatiya Nyaya Sanhita (BNS). An FIR has also been registered to formally address the scale and impact of the fraud.

Angry Investors Demand Answers

The bulk of Torres’ investors were small traders, vegetable sellers, and other lower-middle-class individuals. Many invested their hard-earned savings, ranging from a few thousand rupees to several crores, believing the scheme was backed by legitimate certifications, including GST and CIN numbers.

One distraught investor said, “We trusted Torres because they had GST and CIN numbers on their brochures. The government collected taxes from them, so why isn’t it helping us now?”

Another investor, who had deposited money just days before the shutdown, stated, “I won’t leave the Dadar office until I get my money back. This is our hard-earned money.”

The Company’s Defense: A Coup Allegation

Amid mounting outrage, Torres Jewellers posted a video on its official YouTube account, alleging internal sabotage. The video claimed that CEO Tausif Reyaz and Chief Analyst Abhishek Gupta orchestrated a coup, raided the stores, and robbed the company.

The footage reportedly shows people vandalizing stores, breaking jewellery cases, and looting cash. Torres maintains that CCTV footage has been handed over to the police as evidence of the coup.

The video further claimed, “Realizing that punishment was inevitable, Reyaz and Gupta organized this heist and implicated other employees in their crimes.”

Ongoing Police Investigation

Law enforcement agencies are actively investigating the Torres Jewellers fraud case, working to identify additional accomplices and piece together the full extent of the conspiracy.

Investors are anxiously seeking at least a return of their initial investments, but a resolution remains uncertain. Torres Jewellers has continued to shift the blame onto its CEO and select staff members. Reports indicate that the police have listed several individuals, including Platinum Hern, two directors, the CEO, a general manager, and a store in-charge, as key suspects in the case.

Also read ➡️ How To Check SIM Cards Linked To Your Aadhaar Card: A Step-by-Step Guide

What Happens Next?

While investigations are ongoing, the aftermath of the scam has left thousands of families financially crippled. The Torres Jewellers scam serves as yet another grim reminder of the dangers of get-rich-quick schemes.

Authorities continue to gather evidence and record statements from affected investors. However, for many, the hope of recovering their hard-earned money remains slim.

The Torres case highlights the need for stronger regulatory oversight and public awareness to prevent such financial tragedies in the future. Until then, the victims of this multi-crore fraud await justice and restitution.

Mumbai Police arrest Director, two foreign nationals in Torres scam