Who is Satoshi Nakamoto – The Mysterious Creator of Bitcoin

In the world of digital finance, one name continues to cast a shadow of mystery—Satoshi Nakamoto. Known as the creator of Bitcoin, the first-ever decentralized cryptocurrency, Nakamoto remains an enigmatic figure whose identity is still unknown. Whether Nakamoto is an individual genius or a collective team remains unclear, but their creation has undeniably reshaped the global financial system.

A Vision That Changed Finance Forever

In 2008, Nakamoto introduced the world to Bitcoin through a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” The paper proposed a digital currency system free from central authority, banks, or financial intermediaries. A year later, in 2009, Nakamoto launched Bitcoin and mined the first-ever block, known as the Genesis Block.

Where Is Satoshi Nakamoto From?

Despite endless investigations and speculation, Nakamoto’s origin remains unverified. While the name suggests Japanese roots, linguistic analysis of Nakamoto’s writings suggests a fluent English speaker, possibly from the UK or the US. Timestamps from early Bitcoin-related activities hint at time zones aligning with these regions, but concrete evidence is still absent.

Before Bitcoin: Who Was Nakamoto?

Little is known about Nakamoto’s background before Bitcoin. However, their deep knowledge of cryptography, coding, and economics points to a strong background in computer science. Some researchers believe Nakamoto was part of the cypherpunk movement, a group advocating privacy and cryptographic technology.

Contents

What Is Cryptocurrency and How Does It Work?

Cryptocurrency is a digital currency secured by cryptography, making it secure and nearly impossible to counterfeit. Cryptocurrencies operate on blockchain technology, a transparent, distributed ledger.

- Blockchain Technology: A decentralized ledger that records transactions securely.

- Mining: Cryptocurrencies like Bitcoin are created by solving complex mathematical puzzles.

- Wallets: Users store cryptocurrencies in digital wallets, which can be online (hot wallets) or offline (cold wallets).

- Decentralization: Unlike traditional banking systems, cryptocurrencies are not controlled by a single central authority. Instead, they rely on a distributed network of computers.

- Peer-to-Peer Transactions: Cryptocurrencies allow users to transfer funds directly to one another without intermediaries, making transactions faster and often cheaper.

- Consensus Mechanisms: Networks use consensus algorithms, like Proof of Work (PoW) or Proof of Stake (PoS), to validate and secure transactions.

How Can You Profit from Cryptocurrencies?

Cryptocurrency has become a global financial phenomenon. Here are common ways people profit from it:

- Trading: Buying and selling cryptocurrencies based on market trends.

- Investing: Long-term holding for future gains.

- Staking: Earning passive income by validating blockchain transactions.

- Mining: Earning rewards by solving mathematical puzzles to process transactions.

- Yield Farming: Lending cryptocurrencies to earn interest or fees.

Bitcoin’s Rollercoaster Journey

Bitcoin started with a value close to zero but eventually became the world’s most valuable digital asset. Here’s a quick timeline:

- 2009: Bitcoin had no official value.

- 2010: First transaction—10,000 BTC bought two pizzas.

- 2011: Bitcoin reached $1.

- 2013: Surpassed $1,000.

- 2017: Hit $19,783.

- 2020: Surpassed $20,000.

- 2021: Reached an all-time high of nearly $69,000.

- 2022: Dropped below $20,000.

- 2023: Stabilized between $30,000-$40,000.

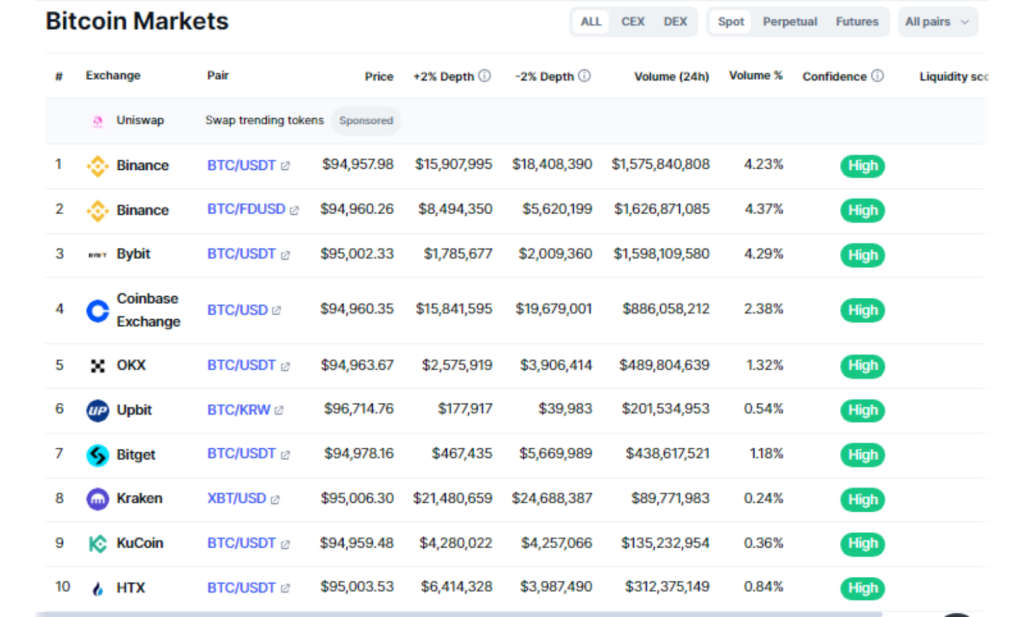

- 2024: Above $94,000

The Road Ahead for Cryptocurrencies

The cryptocurrency landscape continues to evolve. Governments are exploring regulatory measures, while innovations such as decentralized finance (DeFi) and non-fungible tokens (NFTs) gain traction. Despite market volatility, the future of digital currencies looks promising, with potential mainstream adoption on the horizon.

Top 10 Cryptocurrencies in 2024

- Bitcoin (BTC): The pioneer cryptocurrency and digital gold.

- Ethereum (ETH): Known for smart contracts and decentralized apps.

- Tether (USDT): A stablecoin pegged to the US dollar.

- BNB (Binance Coin): Used on the Binance trading platform.

- USD Coin (USDC): Another stablecoin pegged to the dollar.

- Ripple (XRP): Designed for low-cost international payments.

- Cardano (ADA): Known for energy-efficient blockchain solutions.

- Solana (SOL): High-speed blockchain for decentralized apps.

- Dogecoin (DOGE): A meme coin turned serious contender.

- Polkadot (DOT): Designed for blockchain interoperability.

The Legacy of Nakamoto

Satoshi Nakamoto’s vision has revolutionized global finance. Whether Bitcoin remains the dominant cryptocurrency or paves the way for newer technologies, its impact on our financial systems is undeniable. As the world embraces digital currencies, Nakamoto’s legacy continues to grow.

Also read ➡️ How To Buy Cryptocurrency In India: A Step-by-Step Guide

Cryptocurrencies are not just a passing trend—they represent the foundation of a new digital economy.

Stay tuned for more updates on the evolving world of cryptocurrency.