How to Apply for GST Number?

Want to know how to apply for GST number? By following this step-by-step guide, you can navigate the application process with ease and ensure compliance with the GST regulations in India. Streamline your business operations, enjoy the benefits of input tax credit, and contribute to the growth of your enterprise. Applying for a GST number is a crucial step in ensuring the smooth functioning and legality of your business.

Contents

How to Apply for GST Number: A Step-by-Step Guide for Seamless Registration

If you’re a business owner in India, obtaining a Goods and Services Tax (GST) number is a crucial step to ensure compliance with the tax regulations. In this guide, we will walk you through the process of applying for a GST number, providing you with a seamless experience in navigating the complexities of registration.

Understanding the Basics of GST:

Before diving into the application process, it’s essential to have a basic understanding of GST. Goods and Services Tax is an indirect tax levied on the supply of goods and services in India. It has replaced the traditional tax structure and aims to streamline the taxation system, making it more transparent and efficient.

Why is a GST Number Important?

A GST number is a unique identification number assigned to businesses registered under GST. It is essential for conducting lawful business operations, enabling businesses to collect and claim the GST they pay on goods and services. Additionally, a GST number is a prerequisite for availing input tax credit, enhancing the financial viability of your business.

Step 1: Gather Required Documents

To initiate the application process, ensure you have all the necessary documents. These typically include:

- PAN Card: The Permanent Account Number of the business owner.

- Aadhar Card: Proof of identity and address.

- Business Registration Documents: Partnership deed, incorporation certificate, or any other relevant registration proof.

- Address Proof of the Business: Utility bills or rent agreement.

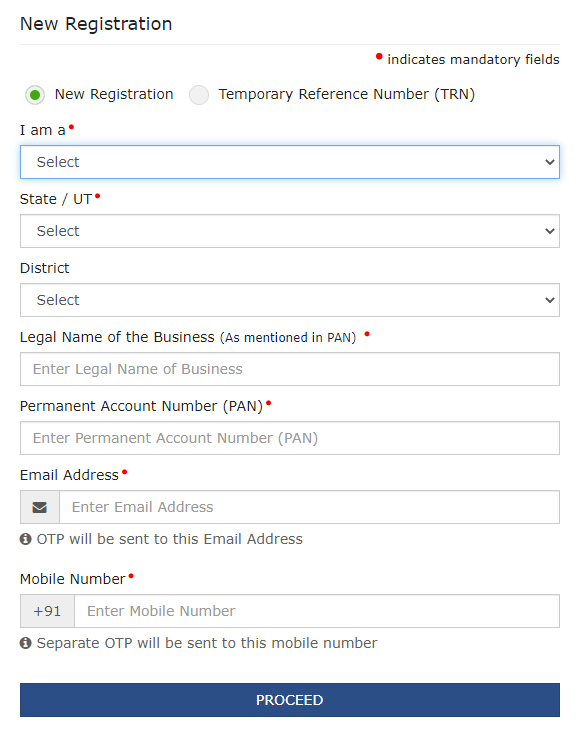

Step 2: Online Application on the GST Portal

The GST registration process is primarily online, making it convenient for businesses. Visit the official GST portal and click on the ‘Register Now’ option. Fill in the required details, including your PAN, email, and mobile number.

Step 3: Verification through OTP

After submitting the initial details, you’ll receive an OTP (One Time Password) on your registered mobile number and email. Enter the OTP to verify your identity and proceed with the application.

Step 4: Fill in the GST Registration Form

The next step involves filling out the GST registration form. Provide accurate information about your business, including its name, address, and nature of the business. Double-check the details to ensure accuracy.

Step 5: Upload Required Documents

Attach the scanned copies of the necessary documents, such as PAN card, Aadhar card, and business registration documents. Ensure that the documents are clear and legible for a smooth verification process.

Also read ⤵️

Step 6: Final Submission and ARN Generation

Once you have filled in all the details and uploaded the documents, submit the application. You will receive an Application Reference Number (ARN) for future correspondence. Keep this number handy for tracking the status of your application.

Step 7: GST Officer Verification

After submission, the GST officer will verify the details provided in your application. In case of any discrepancies, you may be asked to provide additional information.

Step 8: GST Number Allotment

Upon successful verification, the GST officer will allot you a unique GST identification number. This number will be your business’s identity for all GST-related transactions.

For similar news update stay tuned and follow us on Instagram, Facebook and Twitter

Category News : Cricket News | Sports News | National News | Celebrity News | Technology Updates